Non-ferrous metal industry market demand analysis

The supply gap of cobalt has widened, and price increases are still expected to be strong

The current shortage of cobalt in the market is not only reflected in the price, but even buyers who do not have a good cooperation record may not get the goods. This is the reality of cobalt supply.

The price of cobalt in the domestic non-ferrous metal spot market has been close to 600,000 yuan/ton, which is upside-down compared with the previous two years. According to a salesperson from Huayou Cobalt (603799), one of the largest domestic cobalt suppliers, payment before delivery has become an important condition for supply, and even so, it still has to wait half a month to one month.

From the perspective of the industrial chain, the capacity of cobalt mine expansion in the short term is not as strong as the explosive power of downstream demand. First of all, it is controlled by a few giants in cobalt ore, and has strong bargaining power in the downstream. However, the downstream demand expansion has already arrived. Under this fast-slow contrast, the supply and demand of cobalt are extremely imbalanced. The supply gap from 2017 to 2019 will reach 13,000 tons, 16,000 tons and 24,000 tons, respectively.

Major supplier of cobalt ore in the world

In the 14 years from 2000 to 2014, the world's mine cobalt production nearly quadrupled, from 33,000 tons (metal volume) in 2000 to 123,000 tons in 2014, with an average annual growth rate of about 9.8%. However, in the following years, the global cobalt ore output began to stabilize. From 2014 to 2016, the total annual output basically remained at about 120,000 tons. Production is difficult to reach a higher level. On the one hand, the mining cost of associated mines is higher than that of ordinary mineral deposits, and technological transformation and upgrading require a certain period; on the other hand, because cobalt ore is concentrated in the hands of a few mining giants, it is also important to stabilize the cobalt price. Become the common appeal of all major mining giants.

From the perspective of international cobalt pricing power, large multinational producers such as Glencore, Luoyang Molybdenum (603993), Eurasia Resources, Sheritt, and Vale control most of the cobalt resources.

Domestically, Luoyang Molybdenum is a relatively strong comprehensive mine producer, and its cobalt production capacity ranks second in the world. The company's Tenke copper-cobalt mine has the largest reserves and the highest grade in the world.

The world's three major cobalt suppliers have a combined market share of more than 40%

Data source: collated by Qianzhan Industry Research Institute

China's production of ten non-ferrous metals

According to statistics from the "Analysis Report on Non-ferrous Metals Industry Market Prospects and Investment Strategic Planning" released by the Qianzhan Industry Research Institute, in recent years, China's cumulative output of ten non-ferrous metals has achieved steady growth. Specifically, the cumulative output of China's ten non-ferrous metals in 2017 was 53.778 million tons, a cumulative increase of 9.3%. It is estimated that the cumulative output of ten non-ferrous metals in China in 2018 will reach 58.108 million tons, a cumulative increase of about 8.2%.

Analysis of Copper Industry Inventory and Copper Price Increase

Before the holiday, the market was flat, and TC fell slightly. From January 22nd to January 26th, 2018, the TC spot quotations were US$74-86/ton, a decrease of US$1/ton from last week.

From January 22nd to January 26th, 2018, the TC was slightly lowered, indicating that the failure of the Pasar and birla smelters caused the supply of goods to flow into the country and did not have a substantial impact on the fundamentals of copper concentrates. As the Spring Festival approaches, the signing of long-term orders in 2018 has been basically completed, and small and medium smelters have also ended centralized replenishment activities. On the whole, market transactions are flat. It is expected that there will be no major moves before the end of the Spring Festival, and TC basically remains stable. Some large smelters may start replenishment after the holiday, and TC will surely fluctuate further in due course.

TC long-term order for imported copper concentrate from China (USD/ton)

The overall price of non-ferrous commodities continues to rise

In 2017, the price of bulk base metals continued to pick up. For example, except for tin, the LME base metals rose by more than 25%, and aluminum rose by 34%. Domestic base metal prices have also risen by around 20%.

Over the same period, completely different from 2016, precious metals have not been "to be seen", and their prices have fluctuated as a whole. Supported by the decline in the US dollar index, overseas precious metal prices have closed up, and domestic precious metal prices have been affected by exchange rates and have smaller volatility.

The price of basic metals rose overall (increase: %)

In 2018, non-ferrous commodities dominated by global supply and demand will be difficult to follow the old path of 2011, and this cycle is more likely to be longer than expected-while considering the healthier and more resilient economic demand, it should also be included since 2017 The biggest change is that China's supply policy has undergone significant rigid changes. Due to the mild downward trend in China's demand, the growth rate of global commodity demand in 2018 may be flat.

Link to this article: Non-ferrous metal industry market demand analysis

Reprint Statement: If there are no special instructions, all articles on this site are original. Please indicate the source for reprinting:https://www.cncmachiningptj.com

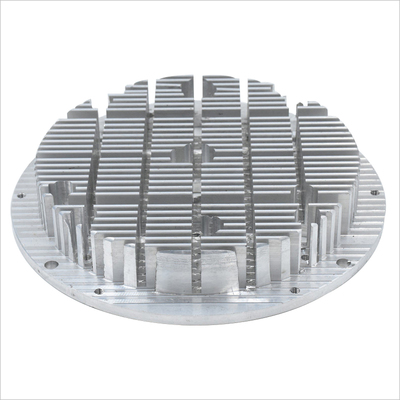

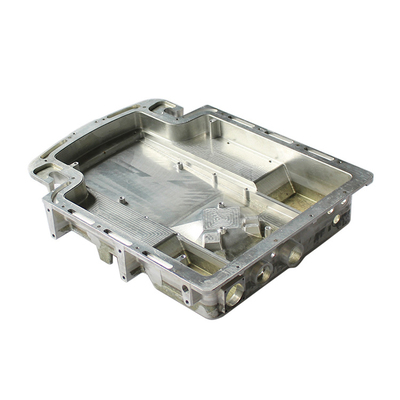

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

PTJ® provides a full range of Custom manufacturer of precision fabricated parts made from aluminum parts, brass parts, bronze, copper parts, high yield alloy, low carbon steel investment casting, high carbon steel and stainless steel alloy. Capable of handling parts up to +/-0.0002 in. tolerance. Processes include cnc turning, cnc milling, laser cutting,.ISO 9001:2015 &AS-9100 certified.

Tell us a little about your project’s budget and expected delivery time. We will strategize with you to provide the most cost-effective services to help you reach your target,You are welcome to contact us directly ( sales@pintejin.com ) .

- 5 Axis Machining

- Cnc Milling

- Cnc Turning

- Machining Industries

- Machining Process

- Surface Treatment

- Metal Machining

- Plastic Machining

- Powder Metallurgy Mold

- Die Casting

- Parts Gallery

- Auto Metal Parts

- Machinery Parts

- LED Heatsink

- Building Parts

- Mobile Parts

- Medical Parts

- Electronic Parts

- Tailored Machining

- Bicycle Parts

- Aluminum Machining

- Titanium Machining

- Stainless Steel Machining

- Copper Machining

- Brass Machining

- Super Alloy Machining

- Peek Machining

- UHMW Machining

- Unilate Machining

- PA6 Machining

- PPS Machining

- Teflon Machining

- Inconel Machining

- Tool Steel Machining

- More Material